Table of Contents

Trading Overview

The truth of artificial intelligence in crypto trading is more complex than usually shown. Let's look at the less talked about elements even when conventional publications mostly highlight the features of the technology. From managing hard forks and network upgrades to analyzing the impact of legislative changes in several jurisdictions concurrently, AI systems in crypto markets face particular hurdles not present in regular markets.

Three main categories nowadays define most modern artificial intelligence trading systems like dxspot: sentiment analysis engines, pattern recognition systems, and prediction models. Still, the most successful traders mix these strategies in unusual ways. Some hedge funds, for example, now use artificial intelligence to identify patterns of other artificial intelligence traders, therefore generating a meta-layer of analysis that conventional trading advice seldom addresses. This "AI versus AI" dynamic is generating fresh market activities challenging accepted trade wisdom.

The Role of Crypto Trading Bots

Although most talks of crypto trading bots concentrate on their technical features, more important concerns center on their conduct on markets. Imagine this: what happens when hundreds of bots designed with algorithms respond to the same market signals? Artificial price swings brought forth by this "bot herding" phenomenon might set off domino effects throughout markets.

Modern crypto trading bots have developed past basic buy-low, sell-high algorithms. Modern systems analyze expected replies from other bots and human dealers using game theory ideas. Among the creative ideas are "stealth modes" that hide bot activity by mimicking human trading patterns and "adaptive personality" systems that routinely change their behavior to evade discovery. The important issue is not just how to use these bots but also how one conducts in a market where they are progressively in charge.

Benefits and Limitations of AI in Crypto Trading

Benefits

The benefits of artificial intelligence in cryptocurrencies trading go beyond the usually mentioned speed and efficiency gains. From social media sentiment to macroeconomic data, artificial intelligence systems shine in spotting intricate links between apparently unconnected events. They use arbitrage possibilities across several exchanges concurrently and can spot minor market inefficiencies resulting from cross-border regulation variances.

|

Benefits |

Description |

|---|---|

|

24/7 Trading |

Continuous market monitoring and trading execution |

|

Emotion-Free Trading |

Eliminates emotional decision-making and psychological biases |

|

Fast Analysis |

Processes large volumes of data in milliseconds |

|

Multi-Market Trading |

Simultaneous trading across multiple exchanges and pairs |

|

Pattern Recognition |

Advanced detection of market patterns and trends |

AI systems have also been particularly adept at recognizing wash trading and other forms of market manipulation, helping traders avoid false market moves. Certain sophisticated systems can even forecast network congestion and change transaction scheduling to reduce costs during busy times.

Limitations

Often more basic than technological problems or data quality concerns are the limits of artificial intelligence in crypto trading. The "normalization of deviance" is one infrequently mentioned issue whereby artificial intelligence systems start to perceive aberrant market situations as normal, therefore enabling catastrophic failures during real black swan events.

|

Limitations |

Description |

|---|---|

|

Technical Failures |

System crashes and connectivity issues can disrupt trading |

|

Market Volatility |

Extreme market conditions can lead to unexpected behavior |

|

Cost Barriers |

High-quality AI solutions can be expensive |

|

Learning Curve |

Requires significant technical knowledge to operate effectively |

|

Data Quality |

Performance depends on the quality of training data |

Another important restriction in artificial intelligence training data is the "echo chamber effect". Multiple artificial intelligence systems run the danger of reinforcing artificial patterns instead of reacting to real market forces as they learn from markets increasingly controlled by AI trading. This can start a self-reinforcing cycle different from underlying economic reality.

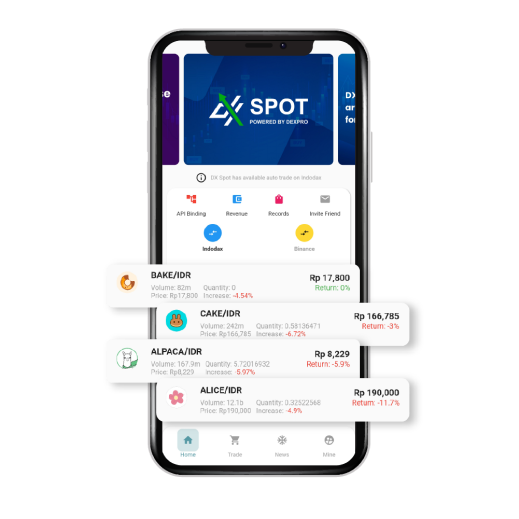

Best AI Trading Platforms

Effective crypto trading depends on choosing the correct artificial intelligence trading platform. The finest systems combine strong security measures with easy-to-use interfaces and strong artificial intelligence ability. Every platform provides special benefits and fits various trading methods and experience degrees.

These are some top artificial intelligence trading systems for coins:

-

TradingView Pro (Advanced technical analysis and AI indicators)

-

3 Commas (AI-powered portfolio management enabled automated trading)

-

Kryll.io (visual strategy builder including artificial intelligence elements)

-

Cryptohopper (machine learning-based trading signals)

-

MetaTrader ( AI-based trading algorithms and custom indicators)

Risk Management

In AI cryptocurrency trading, risk management calls for reconsidering conventional wisdom. Beyond conventional measures like drawdown and volatility, traders have to take AI-specific concerns into account such algorithm crowding, in which too many similar AI systems generate feedback loops intensifying market moves.

Smart traders use "circuit breakers" that turn off artificial intelligence trading under odd market conditions automatically. Understanding that these settings operate differently, they also keep alternative risk models for artificial intelligence-driven marketplaces against human-dominated ones. Some senior practitioners even use "adversarial testing," meaning they purposefully add noise to their systems to guarantee resistance against market manipulation.

Conclusion

In crypto trading, artificial intelligence's future is not in substituting for human judgment but in enhancing it with powers beyond human capacity. Success calls for knowledge not only of how artificial intelligence systems operate but also of their interactions and impact on market dynamics. The difference between artificial intelligence and human trading may blur as crypto markets develop, therefore generating new possibilities and hazards.

The most successful traders will be those who can see beyond present paradigms, knowing both the technical possibilities and constraints of artificial intelligence while preserving a reasonable mistrust regarding its use. The secret to success going ahead might not be having the most advanced AI but rather knowing how to properly employ AI tools while avoiding their typical drawbacks and constraints.

FAQ

How can I find out whether my approach of trading is really fit for artificial intelligence automation?

◄

Not every trading approach gains from artificial intelligence automation. Use the "automation readiness test" to assess your approach; it should have consistent execution patterns, measurable indications, and unambiguous entrance and exit criteria. Strategies mostly depending on news interpretation or sophisticated macroanalysis might perform better under human supervision mixed with artificial intelligence support.

What smallest dataset size would be required to properly train an artificial intelligence trading system?

◄

Although many sources advise basing decisions on one to two years of data, reality is more complex. Data covering at least three to four significant market cycles — including both bull and bear phases — is what you need. To reflect market inefficiencies and cross-exchange dynamics, this usually needs 4+ years of data across several exchanges for crypto markets.

How can I stop wash trading on lesser exchanges from fooling my artificial intelligence with bogus volume?

◄

Apply a "volume validation framework" with different time horizon analysis of trading patterns. Search for natural order book depth distribution; look for wallet clustering tendencies; compare volume profiles with known exchanges. Make filters capable of spotting odd trading patterns with ideal geometric volume distributions.

How best to backtest AI approaches free from typical mistakes?

◄

Beyond conventional backtesting, use "environmental simulation testing" to stress-test your AI by building synthetic market circumstances. Add situations like network congestion, flash crashes, and unexpected liquidity declines. In your simulations, include slippage, exchange costs, and reasonable order filling delays as well.

How may I maximize the performance of my AI in highly correlated markets?

◄

Create "correlation-adaptive" plans whereby your artificial intelligence changes its approach depending on degrees of market correlation. Use "sector rotation" techniques to turn attention to less connected assets during times of strong correlation. Develop dynamic position size guidelines considering general market correlation risk.

Which are the main signals that my artificial intelligence system is beginning to fail or lose performance?

◄

See beyond crude profit/loss measures. Track "strategy drift indicators" include variations in win-rate consistency, average trade length, and position size trends. Use "behavioral fingerprinting" to find out when your artificial intelligence begins making odd or out-of-character trading decisions.

How can my AI be set up to properly manage multi-timeframe analysis?

◄

Design a "temporal hierarchy system" whereby many artificial intelligence modules individually examine several periods before aggregating their findings. Use "timeframe concordance" tests to make sure choices line up throughout several timeframes. Apply weighted voting systems whereby longer durations usually have greater influence in judgments taken at last.

How should one manage unexpected variations in trading costs or exchange rules?

◄

Create an "adaptive cost management system" that keeps an eye on and changes to fit shifting charge policies. Use "policy impact analysis" to run through possible effects of new trade regulations on your approach. Make adaptable execution modules able to rapidly move across exchanges depending on cost effectiveness.

How can I guarantee that, in low volatility times, my artificial intelligence system stays profitable?

◄

Create "volatility-adaptive" plans whereby, depending on market conditions, one may alternate between many trading methods. Apply "range trading modules" especially designed for low volatility times. Create systems for spotting and leveraging small pricing inefficiencies that turn out beneficial on a large scale.

How best to keep several artificial intelligence trading systems running concurrently under observation?

◄

Design a "system hierarchy" whereby a master artificial intelligence supervises and plans several subsystems. Use "cross-system risk monitoring" to guard against overlapping positions or strategy conflicts. Create "system correlation analysis" to make sure none of your several artificial intelligence systems are trading in the same direction.